how to declare income tax

The IRS requires employers to send W-2 forms to their employees no later. The exact amount of your tax payable or refund can only be calculated upon lodgment of your income tax return.

Non-resident tax rates Taxes on employment income.

. A W-2 is a tax form that shows your total paid wages as well as federal state or other income tax withholdings for the year as reported by your employer. Your marginal tax rate is the combined federal and provincial income taxes you pay on all sources of income at tax time. Efiling Income Tax ReturnsITR is made easy with Clear platform.

You can submit your claim electronically when you file your Vermont Income Tax return. The Board of Trustees the Board of Invesco Senior Income Trust NYSE. The Commission retains individual income tax returns for three years after they are filed.

You can efile income tax return on your income from salary house property capital gains business profession and income from other sources. Your income tax bracket determines how much you should save for income tax. You need to file the following two forms to apply for a property tax credit.

Notifying Beneficiaries to Declare Share of Income. W-2 income Limited interest and dividend income reported on a 1099-INT or 1099-DIV IRS standard deduction. Only certain taxpayers are eligible.

Once you ascertain that you have met the pre-requisites to participate in CTRM you can. To request a copy of your return complete Request For Release of Copies of Individual Income Tax Returns F orm 70-698 and mail to. Work out which income you need to declare in your tax return such as employment government and investment income.

If youre already registered for Self Assessment but have not declared all your income you can make a change to your return. If your hobby or side business has a net profit you have to pay income taxes on that net profit even with the new tax law says Irene Wachsler a CPA at Tobolsky Wachsler CPAs LLC in Canton Massachusetts. A simple tax return is one thats filed using IRS Form 1040 only without having to attach any forms or schedules.

A company adopting CTRM is required to complete the CTRM Checklist. Super pensions and annuities. Your company is taxed at a flat rate of 17 of its chargeable income.

The low and middle income tax offset is available for the 201819 201920202021 and 202122 income years and is in addition to the low income tax offset if. Find out whether you need to pay UK tax on foreign income - residence and non-dom status tax returns claiming relief if youre taxed twice including certificates of residence. There is no appeal process provided for in the Income Tax Act 1947.

Putting aside money is important because you may need it to pay estimated taxes quarterly. The control features above are incorporated in the CTRM Checklist XLSX 180KB a checklist which encompasses practice-oriented tax control features as demonstration of sound tax risk controls. You do not have any personal income sources to declare.

Learn Everything about Income Tax in India. Tax-free and taxable state benefits. You meet the household income criteria see form for current year income limit.

For more information see TR IT 2167 Income tax. Rental properties non-economic rental holiday home share of residence etc. If you filed for bankruptcy under chapter 11 of the Bankruptcy Code you must allocate your wages and withheld income tax.

If your software does not support the submission of your personal income sources it will be possible to use your HMRC online services. On your tax return you report the wages and withheld income tax for the period before you filed for bankruptcy. Know about Income tax department slabs efiling calculation payments refunds and Latest updates in Tax.

The tax rate varies by how much income you declare at the end of the year on your T1 General Income Tax Return the form with the exciting-sounding name that you fill out at tax time and where you live in Canada. Declare the income on a tax return. HM Treasury is the governments economic and finance ministry maintaining control over public spending setting the direction of the UKs economic policy and working to achieve strong and.

Individual Income Tax Division PO. Employment income Declare income from your employer job including wages cash allowances and fringe benefits or super contributions. Cases family trust cases.

You may also use the Tax Calculator for Resident Individuals XLS 96KB to estimate your tax payable. Just upload your form 16 claim your deductions and get your acknowledgment number online. For example if you earn 15000 from working as a 1099 contractor and you file as a single non-married individual you should expect to put aside 30-35 of your income for taxes.

Rental income and completing your tax return. Your tax home is the place where you are permanently or indefinitely engaged to work as an employee or self-employed individual. Situations covered assuming no added tax complexity.

Box 1033 Jackson MS 39215-1033 Back to Top. Employment income of non-residents is taxed at the flat rate of 15 or the progressive resident tax rates see table above whichever is the higher tax amount. Whats new for 202122 Low and middle income tax offset.

Your Form W-2 will show your total wages and withheld income tax for the year. VVR the Fund approved an increase in the monthly distribution amount payable to common shareholders pursuant to the. Most taxpayers use a 1040 form to report their income tax for the year and any refund or additional tax owed.

The tax exemption scheme for new start-up companies and partial tax exemption scheme for companies are tax reliefs available to reduce companies tax bills. Please refer to How to Calculate Your Tax for more details. You must declare hobby income The IRS wants you to declare all your hobby income even if its a small amount of money.

You must declare rent and payments relating. Income you must declare. If you disagree with the ruling you must declare in your annual Income Tax Return for the relevant Year of Assessment that you have obtained and chosen not to rely on the advance ruling.

Applying for the CTRM. Distributing Income to Non-Resident Beneficiaries. HM Revenue and Customs HMRC is reminding Self Assessment customers to declare any COVID-19 grant payments on their 2020 to 2021 tax returnMore than 27 million customers claimed at least one.

Form HS-122 Homestead Declaration and Property Tax Credit Claim. Your tax home is the general area of your main place of business employment or post of duty regardless of where you maintain your family home. An advance ruling is final and the taxpayer cannot appeal against the ruling ie.

Contact the Income Tax helpline if your income from renting out a property was between 1000 and 2500.

Income Tax Declaration Form 09 010 Pdf Tax Refund Payments

How To File An Income Tax Return In Spain Expatica

Step By Step Guide To Filing Your Personal Income Tax In 2019

What Is Income Tax Declaration Meaning Definition Akrivia Hcm

How To Get Organized Using An Income Tax Binder The College Investor

How To File An Income Tax Return In Spain Expatica

Do I Declare A Dividend On A Tax Return If It Is A Drip

Malaysia Personal Income Tax Guide 2020 Ya 2019

Self Declaration Of Individual Income Tax

Businessman Hands Holding Pen Calculating And Filling Out Income Tax Return Form Man Files A Refund Document Submitting Of Declaration Document Taxpayer Vector Illustration Royalty Free Svg Cliparts Vectors And Stock Illustration

Tax Return Vector Art Icons And Graphics For Free Download

Income Tax Declaration List Of Investment Proofs Fy 2020 21

Texas Imperial Company Form 1120 U S Corporation Income Tax Return 1955 The Portal To Texas History

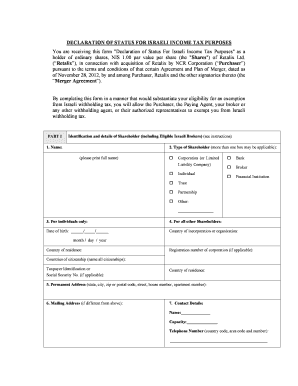

Declaration Of Status For Israeli Income Tax Purposes Fill Online Printable Fillable Blank Pdffiller

Fillable Online Employee39s Income Tax Declaration Form Bhagwant Group Fax Email Print Pdffiller

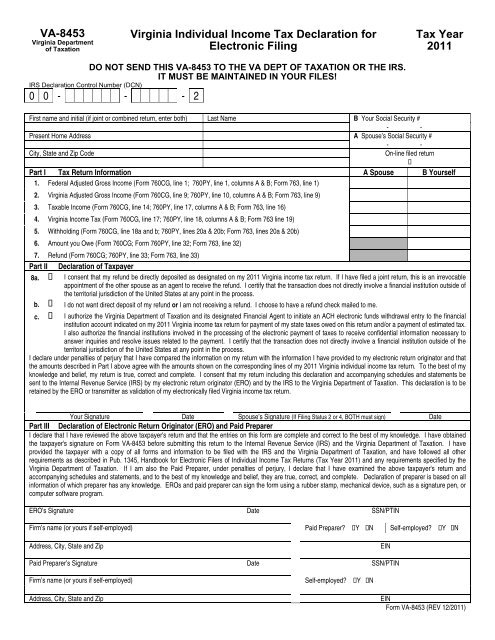

Va 8453 Virginia Individual Income Tax Declaration For Electronic

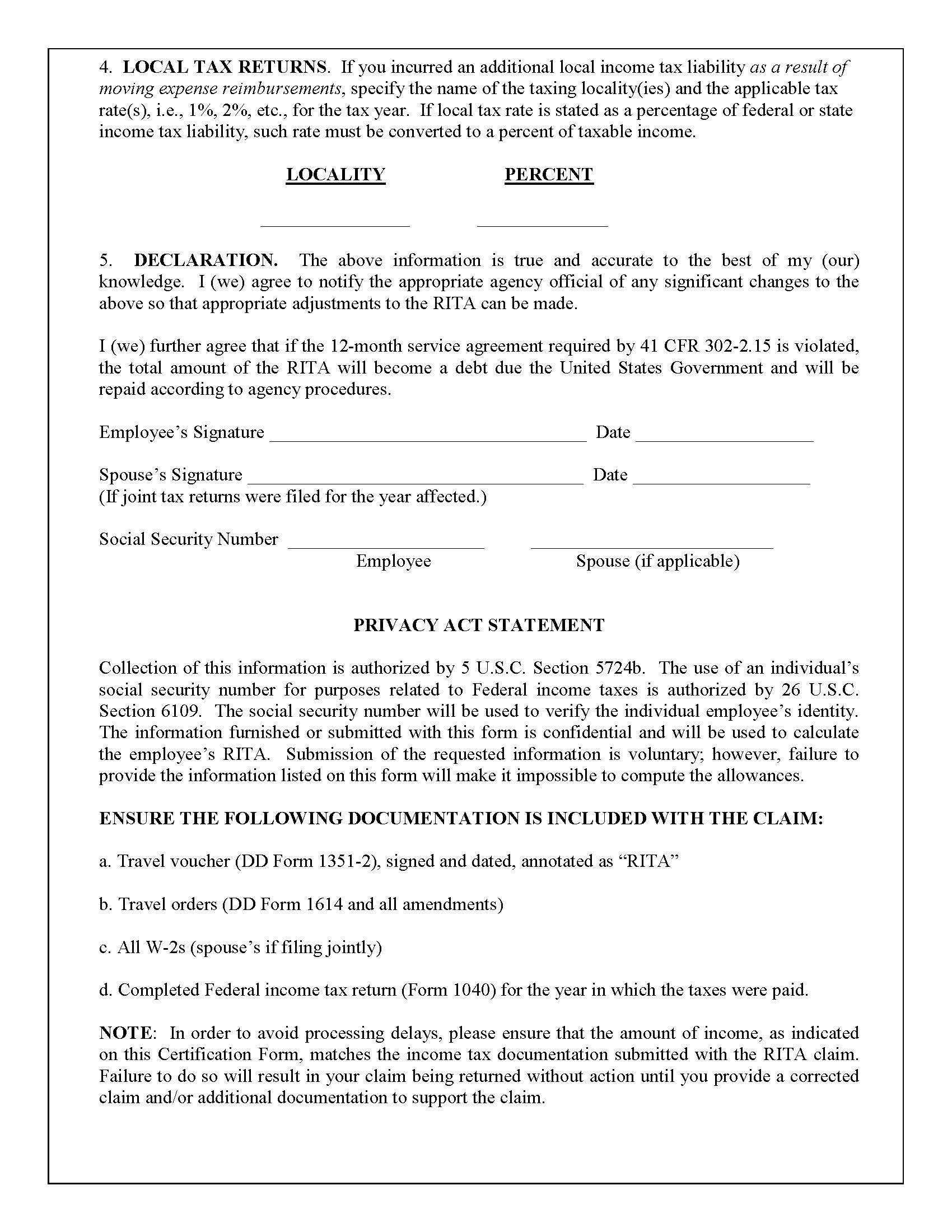

Defense Finance And Accounting Service Civilianemployees Civilian Permanent Change Of Station Pcs Civilian Pcs Entitlement Guide Relocation Income Tax Allowance Rita

Income Tax Declaration Scheme Undisclosed Income

What Is Income Tax Declaration Itd By Aradhana Gotur Tickertape Medium

0 Response to "how to declare income tax"

Post a Comment